- Stillwater Public Schools

- Booster Handbook

Booster Handbook

-

DISCLAIMER: This information is presented with the intent of providing accurate and informative materials of a general nature only. Because this office cannot engage in offering you legal or tax advice, we strongly encourage you to seek advice from your personal attorney and tax advisor based upon your unique situation.

Sanctioning Overview

-

Oklahoma School law requires that all money raised for student programs be controlled by the Stillwater Public Schools (the “District”). There is an exception for organizations sanctioned by the Board of Education (the “Board”). If an organization is approved for sanctioning as detailed in Stillwater Public School’s Policies and Procedures, CFBB and CFBB-P, the organization may control its own funds, exempt from the statutory controls over student activity funds as set forth in the Oklahoma School Code, Okla. Stat. Tit. 70, §5-129.

Stillwater Public Schools Sanctioning Policies

Stillwater Public Schools Policy CFBB, Sanctioning of Parent Organizations, Booster Clubs, and Associations, details the criteria to be used in determining if an organization will be recognized (sanctioned) by the Stillwater Board of Education as a viable booster club or parent organization. Policy CFBB-P further details the initial and annual application procedures and Policy CFBB-E is the application for sanctioning. The board expects Sanctioned organization officers and the school faculty/sponsor to be familiar with these policies and procedures.

Sanctioning is granted on an annual basis, but may be withdrawn at any time by the Board if it believes it is in the best interest of the District to do so. The decision by the Board whether to grant or deny sanctioning is final and non-appealable. All applications must be received in the business office prior to September 1 of each year and sanctioning of organizations will typically occur at the September board meeting of each year. Initial sanctioning may be requested by an organization at any board meeting.

A sanctioned organization is not an authorized agent or arm of the District, but a separate and apart legal entity. As such, the organization is responsible for complying with all federal and state laws, including, but not limited to, taxation (income and sales tax) and federal Title IX compliance (as determined and coordinated by the District). The organization should obtain its own tax identification number from the IRS. This can be done by completing IRS Form SS-4 on-line at http://www.irs.gov, by phone at 1-800-829-4933, by fax at 1-859-669-5760 or by mail. The organization may not use the District’s tax identification number or an individual’s social security number.

A sanctioned organization is on its own both financially and with regard to personal liability. The sanctioned organization cannot insinuate that it is representing the District and cannot obligate or attempt to obligate the District. In any business dealings, vendors should be aware that they are doing business with the sanctioned organization and not the District. As a result of this distinction, school district employees cannot have their name on a booster bank account, write checks, or use a bank card. It is recommended that a surety bond cover the treasurer and any officers or members with access to the money. The surety bond should be for the amount the organization will raise during the year. If an organization’s treasurer or another member mishandles money, the District cannot provide any legal assistance or financial relief. The organization should adopt internal controls to mitigate its risk of financial loss. Guidelines for internal control procedures in a small organization are provided at the end of this document. If an officer or member of a booster club suspects mishandling of money they should address it immediately with booster officers and membership. This should also be reported the school district who may investigate and/or require an audit of the booster organization.

Booster Finances

-

-

A sanctioned organization cannot insinuate that it is representing the school district or obligate the district

-

Vendors should be aware that they are doing business with a parent-teacher booster organization, not the district

-

Boosters should consider a surety bond for officers with financial duties

-

If an organization’s treasurer mishandles money the district cannot provide legal assistance or relief.

-

The district can revoke or suspend sanctioning and require future fundraising activities to be managed through school district activity funds.

-

-

Officers of a sanctioned organization are not covered by District insurance

Financial Issues

Information provided by RFR, Karen Long, Attorney representing Stillwater Public Schools

Part I: Paying & Collecting Sales Tax Issues

Paying Sales Tax

Organizations are required to pay sales tax on their purchases UNLESS you are in an exempt category. Buyers are exempt from paying sales tax under the following circumstances:

- · Organization is a 501(c)(3)

and - · Organization is a “parent-teacher organization or association”

The 501(c)(3) requirement is one reason that all booster clubs and PTAs should consider becoming 501(c)(3)s. You must request an exemption certificate from the Oklahoma Tax Commission to be able to claim that you are exempt from paying sales tax.

Collecting Sales Tax Issues

You must collect taxes on the sales on purchases of goods and services if your Organization is the seller unless your organization falls under an exemption from collecting sales tax for governmental and nonprofit entities. Title 68 Oklahoma Statutes Section 1356 (13) lists sales made by the following as exempt from collection of sales tax on the sale:

-

- A public school

-

A private school offering instruction for grades kindergarten through 12th grade

-

A public school district

-

A public or private school board

-

A public or private school student group or organization [regardless of whether or not the group is a 501(c)(3) or not]

-

A parent-teacher association or organization [regardless of whether 501(c)(3)]

-

Public or private school personnel for purposes of raising funds for the benefit of a public or private school, public school district, public or private school board, or public or private school group or organization

-

All PTAs are exempt from collecting sales tax on items sold because they are clearly a parent-teacher association. The issue with regard to booster clubs is whether they are a “parent-teacher organization.”

-

If a booster club has some teachers that are legitimately a part of the group there is an argument that the booster club is a “parent-teacher organization”.

-

As a result, booster clubs are encouraged to:

-

Obtain 501 (C)(3) status; and

-

Use as a part of the name of the club “parents and teachers organization”

-

For example: “Stillwater Parents/Teachers Basketball Booster Organization”

-

-

This would enable a booster club to go to the Oklahoma Tax Commission (OTC) and say:

-

“We are a parent-teacher organization”

-

“The Articles of incorporation and bylaws say that our booster group is a parent-teacher organization”

-

“Our organization documents say we are a parent-teacher organization”

-

-

-

Final Summary of Sales Tax Issues

-

If your organization is buying items, then to avoid paying sales tax to the vendor, your organization must be:

- A 501(c)(3)

and - A Parent-Teacher Organization

- A 501(c)(3)

-

If your organization is selling items, then to avoid collecting sales tax, your organization must be:

-

A Parent-Teacher Organization

-

(There is no 501(c)(3) component to this)

-

The only way to deal with both sales tax issues is to be both a parent-teacher organization and a 501(c)(3).

Part II: Transactions with Employees of Stillwater Public Schools (Hiring, etc.)

-

Booster clubs and PTAs are not allowed to hire, employ, or pay school district employees or anyone else (coaches, technicians, independent contractors, choreographers, etc.) to do things to benefit the booster club or the school sport or activity unless approved by the school district. District requirements and Title IX requirements must be met.

-

Beyond raising Title IX issues, these hires also implicate serious state and federal tax issues.

-

The IRS has taken the position that payments to district employees by sanctioned organizations for services or gifts are subject to income and employment taxes as if they had been paid by the District. Payments for services related to an individual’s employment with the school district should be subject to all applicable withholdings.

-

Payments for services related to the teacher's or sponsor's employment with Stillwater Schools should be made through the District’s payroll system in order to comply with IRS regulations. The organization will reimburse the District the compensation amount plus employer FICA.

-

Gifts related to the teacher’s or sponsor’s employment with Stillwater Schools are also considered taxable compensation. The exception is de minimus gifts of items (clothing, flowers, plaques, etc.) that are given on occasion like the end of season or for a holiday.

-

Gifts of cash or gift cards related to the teacher’s or sponsor’s employment with Stillwater Schools are never excludable from income. Payments to district employees in cash or gift cards should not occur unless approved through the district.

-

District employees may be reimbursed for qualified business expenses without tax consequence. Such expenses must have appropriate receipts to substantiate the business purposes.

-

If a sanctioned group wishes to give a teacher a gift card to purchase supplies without it being taxable to the teacher, the card should be donated to the school and kept in the school’s financial office. The teacher can then check out the gift card and return the appropriate receipts which substantiate the business purpose of the purchases.

-

See “Stipends Paid by Sanctioned Organization” handout at the end of this document for more information about payments to individuals.

Part III: Section 501(c)(3)

The concept of becoming tax exempt under Section 501(c)(3) of the Internal Revenue Code is strictly a federal income tax and gift and estate tax issue. A section 501(c)(3) ruling is a ruling by the IRS which determines that the booster club is generally exempt from income tax on the income which it earns and is a ruling which advises contributors that their gifts to the booster club are deductible for federal income, gift, and estate tax purposes. PTAs that are members of the National Parent Teacher Association are exempt under a group and national exemption. More information on the criteria and process for applying can be found in IRS Publication 557. There are both benefits and detriments to obtaining 501(c)(3) status.

Benefits:

-

All income earned by the booster club is tax exempt. Absent such classification, the income of the booster club is subject to taxation.

-

All contributions made to the booster club are tax deductible to the donor. If the booster club is not a recognized 501(c)(3) then the contributions are not deductible.

-

It is generally recognized that corporations and foundations that make gifts to charities require, as part of their gift giving guidelines, that the charitable recipient be sanctioned under Section 501(c)(3) of the Internal Revenue Code.

-

Title 18, Section 867 offers broad protection from liabilities of directors of nonprofit corporations that are exempt from tax under 501(c)(3). This protects individual members from personal liability for damages resulting from (a) a negligent act or omission of an employee or nonprofit or (b) any negligent act or omission of another director.

-

501(c)(3) status helps establish an exemption from paying sales tax.

Detriments:

-

Legal, accounting and filing fees to apply for 501(c)(3) status takes time and may be costly.

-

Filing a nonprofit Certificate of Incorporation with the Secretary of State,

-

The creation and adoption of by-laws for the corporation;

-

The preparation and filing of an application with the IRS requesting the IRS to determine that the booster is tax exempt

-

-

Generally, the cost, including filing fees, is $3000 - $3500.

-

If the booster club anticipates having annual gross receipts less than $50,000, then the applicant can file online, using IRS form 1023 EZ

-

The application is a difficult application to submit

-

The application requires financial information as well as projections of financial information

-

-

-

-

There is an annual filing requirement (IRS Form 990).

-

Most tax-exempt organizations with gross receipts of $50,000 or less are not required to file Form 990 or 990-EZ if they electronically submit Form 990-N (e-Postcard) annually.

-

Failure to file for three consecutive years triggers automatic revocation of tax-exempt status and could result in penalties.

-

The assistance of an accountant or tax attorney is recommended

-

Lack of continuity can be a problem if incoming officers do not understand their filing obligations or if correspondence continues to go to the outgoing officers.

-

Part IV: Online Alternatives to support Boosters

(No warranties expressed or implied based on the mention of this. Reports have been received regarding the ease and affordability of use.)Parent Booster USA (PBUSA)

PBUSA touts that joining is quick, easy, and inexpensive. And, that Federal 501(c)(3) tax-exempt status is immediate.

-

Go to www.parentbooster.org

-

Select “Join Now”

-

$495/startup for 501(c)(3) status upon approval, IRS EIN

-

$345/maintain your 501(c)(3) status by filing IRS form 990N with increased fees if a 990EZ or full 990 form are required.

-

There are a number of free resources on the website and additional support center tools if you are a member.

Title IX Issues

Title IX Issues (Gender Equity in School Sports)

Title IX of the Education Amendments of 1990 provides: “No person in the United State shall, on the basis of sex, be excluded from participation in, be denied the benefits of, or be subjected to discrimination under any education program or activity regarding federal financial assistance.”

Under Title IX, all donations (money or in-kind contributions) must be monitored by the school district and boosters, and booster clubs must cooperate with monitoring.

Stillwater Public Schools has the ultimate responsibility for Title IX compliance. In cases on non-compliance, the argument that a booster club provided funding that the District could not is not a legal defense. Title IX compliance encompasses the areas of trips, camps, facilities, equipment, coaches, uniforms, meals, tournaments, banquets, student awards, and letter jackets.

More complete information about how Booster clubs can affect Title IX compliance can be found in a section later in this document.

Recommended internal controls

All booster clubs and parent organizations are encouraged to follow the guidelines below:

-

All activities (fundraising and proposed expenses) should be voted on by the club or organization and recorded in the club’s minutes.

-

All checks issued by the club should bear the signatures of the club’s treasurer and one other officer. No school employee is authorized to have his/her name on any club or organization financial account.

-

All expenses should have documented proof (a receipt or invoice). The check number and date of payment should be written on receipt or invoice. Each month, the club minutes should reflect membership approval of all bills paid.

-

A fundraising income/loss statement should be completed and submitted to the club for approval and recorded into the club’s minutes.

-

A monthly financial statement should be submitted at each club meeting for approval and recorded into the club’s minutes.

-

At the end of the year, the club treasurer should submit a financial report demonstrating all activities for the year.

-

The president should appoint an internal audit committee and the appointments should be noted into the club’s minutes. Club officers should not be a member of the internal audit committee. The internal audit committee should conduct an annual audit of the club’s financial records for the year ended. This audit should be completed prior to the transfer of financial records to the next treasurer. The audit should be performed by someone who is independent from day-to-day financial activities. Ideally, this audit should be performed by a group of three individuals; however, if the membership size does not allow, the audit may be performed by two individuals.

-

The club should obtain a bond to cover all club officers who are permitted to handle checks and depositing of funds.

-

All money collected should be counted by at least two club representatives before forwarding the funds to the treasurer for deposit. The club representatives should sign a money collection report.

-

All monies should be deposited into the bank within 24 hours of collection.

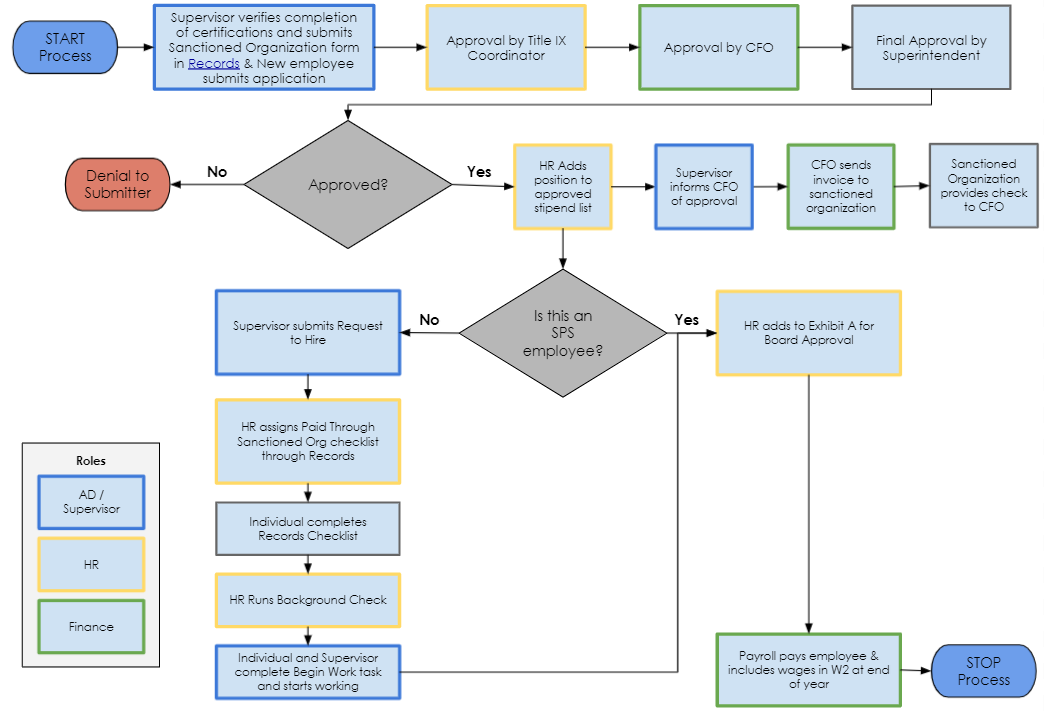

Employee Stipends, Coach Payments, & Other Payments to Individuals

-

All stipends must be paid by the district

-

Submit a request to pay an individual to the Coach/Sponsor/Principal.

-

The district ensures compliance with Title IX or other factors (including training and background checks).

-

The School Board approves the payment either through Exhibit A on the monthly board report.

-

The booster has to pay the district for the amount of the employee payment, employer FICA (7.65%), and Teacher’s Retirement (9.5%, if required).

-

Year-round employees are paid over the course of their contract like a district paid stipend unless otherwise approved; non-employees can be paid either monthly or at the end of the season/term.

-

The individual will receive a W-2 from SPS at the end of the year.

-

-

Other Payments to individuals: officials, team photographer

-

No ongoing relationship with the team

-

Booster can make payments directly to these individuals

-

Booster must issue a 1099 at the end of the year and must present a copy to the district as part of their annual application

-

-

Reimbursements for approved expenses are not income

-

All reimbursements should be documented with a receipt provided by the person requesting reimbursement

-

-

Title IX for Boosters

-

Information provided by RFR, Karen Long, Attorney representing Stillwater Public Schools

Title IX Issues (Gender Equity in School Sports)

Title IX of the Education Amendments of 1990 provides: “No person in the United State shall, on the basis of sex, be excluded from participation in, be denied the benefits of, or be subjected to discrimination under any education program or activity regarding federal financial assistance.”

There are two prongs to Title IX: participation rates; benefits and services

- Booster club issues arise with benefits and services

- School districts must ensure that equivalent benefits and services are provided to both sexes in athletic programs

- This does not require identical benefits and services

- The fundamental premise: If booster clubs provide benefits and services to athletes of one sex that are greater than what the school is providing to athletes of the other sex, then the school must take steps to ensure that the benefits and services are equivalent for both sexes

- Stillwater Public Schools may not use lack of its own funds to justify failure to insure similar benefits to boys and girls

- The district must assure that areas such as equipment, uniforms, coaches, travel, and facilities are provided on an equivalent basis regardless of booster club funding and the resulting benefits and services must be equivalent for both sexes.

- Illustrative problem areas include, but are not limited to:

- Paying for out-of-state travel by booster clubs of a male sport but not a female sport

- Paying for certain tournament entry fees for a male sport and not a female sport

- Food for athletes of only the football team

- Coaches of male teams receiving extra compensation that is not available for coaches of female teams

- Booster club donations may involve monetary or nonmonetary donations

- Relevant Stillwater Public Schools staff are required to constantly monitor funds or contributions whether monetary or non-monetary

- All coaches must notify the site athletic director of all donations and contributions whether monetary or nonmonetary – this includes services of volunteer or lay coaches

- Stillwater Public School District athletic directors must monitor the equitable distribution of funds

- The district has a legal duty to track contributions from outside sources, including booster clubs and individual boosters.

Title IX Summary

Under Title IX, all donations (money or in-kind contributions) must be monitored by the school district and boosters, and booster clubs must cooperate with monitoring.

The Stillwater Public Schools has the ultimate responsibility for Title IX compliance. In cases of non-compliance, the argument that a booster club provided funding that the District could not is not a legal defense. Title IX compliance encompasses the areas of trips, camps, facilities, equipment, coaches, uniforms, meals, tournaments, banquets, student awards, and letter jackets.

Stillwater Public Schools is committed to equal opportunity for male and female student athletes to include participation opportunities and equal treatment and benefits, and shall comply with Title IX of the Education Amendments of 1972.

The school district's Director of Human Resources has been designated as the Title IX Coordinator. The Title IX Coordinator oversees the district's compliance with Title IX and handles inquiries or reporting of possible gender inequity or inequality with respect to the school district's sports offerings. Any individual may report a violation of Title IX by completing a Discrimination Grievance Complaint Form and then submitting it to the Title IX Coordinator.

Stillwater Public Schools Non-discrimination Statement

-

The Stillwater Board of Education is committed to a policy of nondiscrimination. There will be no discrimination in this district on the basis of race, religion, color, national origin, sex, pregnancy, gender, gender expression or identity, disability, genetic information, veteran status, sexual orientation or age in its employment, programs and activities. This policy will prevail in all matters concerning staff, students, the public, employment, admissions, financial aid, educational programs, events, and services, facilities access, and individuals, companies, and firms with whom the board does business. The district also provides equal access to the Boy Scouts of America and other designated youth groups.

The following administrator has been designated to handle inquiries regarding the district’s non-discrimination policies:

- Section 504/Title II of the Americans with Disabilities Act (for questions or complaints based on disability)

- Title VI of the Civil Rights Act (for questions or complaints based on race, color and national origin)

- Title IX (for questions or complaints based on sex, pregnancy, gender, gender expression or identity)

- Age Act (for questions or complaints based on age)

In addition, any individual who has experienced some other form of discrimination, including discrimination not listed above, may contact:

Director of Human ResourcesStillwater Public Schools314 South LewisStillwater, OK 74074405-533-6300

[email protected]District Title IX Coordinator - Chief Human Resources OfficerDistrict Title IX Investigators - Principals / SupervisorsDistrict Title IX Decision Makers - SPS District AdministratorsOutside assistance may be obtained from:

U.S. Department of Education, Office for Civil RightsOne Petticoat Lane, 1010 Walnut Street, Suite 320Kansas City, MO 64106816-268-0550; 816-268-0599 (fax); 877-521-2172 (TTY)Email: [email protected]Racial discrimination shall include racial slurs or other demeaning remarks concerning another person's race, ancestry, or country of origin and directed toward an employee, a student or a visitor.

Stillwater Public Schools does not discriminate on the basis of race, religion, color, national origin, sex, pregnancy, gender, gender expression or identity, disability, genetic information, veteran status, sexual orientation or age in its employment, programs and activities.

Related Policies and Procedures and Training Materials:- K-12 Virtual Certified Title IX Coordinator Training

- Title IX Regulations: Revisions Training

- FB-Sexual Harassment of Students

- FB-E1-Sexual Harassment Incident Report Form

- FB-E2-Written Notice to Known Parties Regarding Allegations of Sexual Harassment

- FB-E3-Written Report

- SPS Title IX Discrimination Formal Complaint Form

Title VII Policies

Photography, Video, and Streaming/Broadcasts

-

-

Sanctioned organizations are encouraged to make efforts to document their activities through photo and video documentation

-

While SPS has permission to release photos of students for school use and promotion, (unless it is requested by parents that their child not be photographed/recorded), sanctioned organizations are separate entities. A media release form for sanctioned organizations is available for your convenience.

-

All photos, video, and broadcasts must comply with board policies and any applicable laws, such as copyright, or agreements SPS, the Athletic Department, or OSSAA may have entered into.

-

Use of broadcast equipment/streams may incur a cost to the district, or violate broadcast agreements. Please check with appropriate administrators before initiating any broadcast or stream.

-

-

Booster Social Media Accounts

-

At Stillwater Public Schools, we understand that social media can be a fun and rewarding way to share your organization's activities with family, friends and co-workers around the world. However, the use of social media also presents certain risks and carries with it certain responsibilities. In order to assist our sanctioned organizations, we have established these guidelines for social media.

Any new accounts created require the approval of the SPS PR & Communications Coordinator.

- Accounts presenting as an SPS team or extracurricular activity

- Account must have:

- At least one coach or activity sponsor employed by the district

and - At least one administrative staff member from the department/school

or - the SPS PR & Communications Coordinator as an administrator/login credential holder.

- At least one coach or activity sponsor employed by the district

- Only one account per platform per team/activity (Treat all levels of a sport as one. There should not be separate accounts for Varsity, Junior Varsity, Junior High, Middle School, etc.)

- Any new accounts created require the approval of the SPS PR & Communications Coordinator.

- The SPS staff member account holders shall inform anyone managing social media accounts of expectations, agreements, policies, and laws regarding sharing of photos, video, and streams.

- Account must have:

- Accounts presenting as an Sanctioned Organization

- To facilitate accurate communication, login credential holder's names and contact information should be provided to the district via the activity coach/sponsor and at least one administrative staff member from the department/school

- To prevent confusion in audiences, accounts must be clearly designated as the sanctioned organization, not as the activity being supported.

- By Name

- Examples of Appropriate Account Names

- Stillwater WhateverBall Boosters

- Pioneer ThataBall Supporters

- Examples of Inappropriate Account Names

- Stillwater WhateverBall

- Pioneer ThataBall

- Examples of Appropriate Account Names

- By a disclaimer in the account About or Bio section.

- For Twitter, Instagram, or other accounts with limited length bios should contain the following as appropriate: "A Booster/PTA/PTO account - views & opinions expressed are our own."

- For Facebook, Organization Websites (preferably in a footer on every page), and other unlimited length profiles should include: "This page/group is managed by the -Full Name of Organization- The views & opinions expressed are our own, and do not necessarily reflect those of Stillwater Public Schools."

- By Name

- Only one account per platform per activity (Treat all levels of a sport as one. There should not be separate accounts for Varsity, Junior Varsity, Junior High, Middle School, etc.)

- The SPS staff member account holders shall inform anyone managing social media accounts of expectations, agreements, policies, and laws regarding sharing of photos, video, and streams.

- Accounts presenting as an SPS team or extracurricular activity

School District Approved Social Media Accounts

-

Any employee who wishes to create a social media account to be utilized with operations of the school district, a classroom activity, or an extracurricular club or group associated with the school district shall comply with all District policies and state laws on the use of district-owned hardware, software and networks apply, as relevant, to the use of social media for a school, class or program.

Initially, the employee shall notify the Superintendent or Building Principal Public Relations & Communications Coordinator of a request to establish a social media site for a school, class or program. Employees shall be prohibited from using a personal Facebook page or personal social media account for school-related purposes. All social media accounts created shall have expectations for acceptable use listed on the social media site that are compliant with the District’s Stillwater Public Schools’ expectations for acceptable use.

Accounts created shall not include posts that advocate for or against a political candidate or ballot initiative.

Employees and students shall refrain from posting or otherwise publishing images that include students that have requested, through the Public Relations & Communications Coordinator, their image not be shared without parental release forms on file for the specific social media site that was created.

The site’s security settings should allow only approved participants access to the site. A building administrator or the Public Relations & Communications Coordinator must be approved as an administrator participant for supervisory purposes.

All school policies regarding appropriate behavior in school or the classroom should be applied online. Students shall be disciplined for inappropriate posts or uploads which would violate district disciplinary policies.

Prior to use of the school district’s logo or school-specific logos or mascots approval is required from the Superintendent or Public Relations & Communications Coordinator.

Staff Members & Social Media

-

At Stillwater Public Schools, we understand that social media can be a fun and rewarding way to share your life and opinions with family, friends and co-workers around the world. However, use of social media also presents certain risks and carries with it certain responsibilities. In order to assist employees in making responsible decisions, we have established these guidelines for appropriate use of social media.

General Guidelines

Consult Stillwater Public Schools District policy on Internet safety and appropriate use (Stillwater Public Schools District Policy EFBCA), as well as the employee handbook. Be aware that all existing policies and behavior guidelines extend to school-related activities in the online environment as well as on school premises.

Use good judgment. Think about the type of image being conveyed on behalf of the district when you are posting to social networks and social media sites. Remember that what is posted will be viewed and permanently archived. Social media websites and blogs are not private. Internet search engines can find information years after it was originally posted. Comments can be forwarded or copied, and archival systems save information even if a post is deleted.

The district considers an employee’s use of any electronic media for the purpose of communicating with a student or a parent to be an extension of the employee’s workplace responsibilities. Accordingly, the board expects school personnel to use professional judgment and appropriate decorum when using any social media in this fashion. School district administrators may require an employee to provide access to any websites used by him or her for communication with students or parents and to produce copies of any electronic communication with students or parents, including text messages, web page posts, etc. This policy does not authorize an administrator to inspect an employee’s personal devices without the employee’s express consent.

For the protection of both students and staff, whenever feasible, student contacts should be made with district-sponsored software (such as @stillwaterschools.com email and teacher websites), which provide both administrators and parents/guardians with access to the messages. For software not provided by the district (such as texting, Twitter, Facebook, etc.), employees should, whenever feasible, enable and preserve electronic communication records for a minimum of 60 days.

Social Networking Websites

Personnel shall abide by the following requirements regarding use of social networking websites, even when done in their personal time, using personal property. These provisions do NOT apply to former students who have graduated from high school NOR to students who are also the teacher’s relative in the first or second degree (e.g. son, daughter, niece, nephew).

- Fraternization with students using social networking websites on the Internet:

- Inappropriate contact with students or parents via e-mail, phone, or other devices is prohibited;

- School personnel must exercise caution regarding social media contacts with students. A staff member who is “friends” with a student in such contexts is responsible for all of the information accessible to the student via the social media service. If a staff member allows any current students in the district to be their “friend” or form a similar connection, the staff members may not post items or send messages with sexual content, nor may they post items or send messages exhibiting or advocating the use of drugs or alcohol. This restriction is not intended to interfere with appropriate professional contacts or counseling, such as professional contacts and counseling between a student and a staff member who is also a youth minister, scout leader, appropriate commercial transactions, etc.

- School personnel and sponsors should use, and direct students to use, the school e-mail system or other school-sponsored software for contacts whenever feasible, rather than personal emails or messaging services on a social networking site; voice telephone contacts should use the school’s telephone system whenever feasible;

- Student/teacher contacts via e-mail, phone, or other devices should be limited to school-related or other professional business (e.g. assistance with homework, logistics of school-sponsored extracurricular events, appropriate contacts between a youth minister and a student, appropriate contacts with a student who is a babysitter or lawn care worker); staff shall not send messages that are personal in nature and not related to the business of the school or other community organization or that contain confidential information to persons not authorized to receive that information.

- Before using social media, school personnel and sponsors should be aware of current educational technology best practices and appropriate privacy settings to ensure that information about students is private and not accessible, especially by personal friends of the employee/sponsor.

- School district personnel and sponsors may not post items on social networking websites with sexual content if they are identifying themselves as an employee of the district;

- Employees may not post items exhibiting or advocating use of drugs or alcohol if they are identifying themselves as an employee of the district;

- Employees may not post pictures, video, or audio of students participating in school sponsored activities if the student’s parent (if the student is under 18) or the student (if the student is 18 or over) has requested to opt out of media release.

Note that when using a school district e-mail address or equipment to participate in any social media or professional social networking activity, the communications are public records, and employees are responsible for the content in the communications.

As per state law, employees are discouraged from sharing content or comments containing the following when directed at a citizen of the State of Oklahoma:

- Obscene sexual content or links to obscene sexual content;

- Abusive behavior and bullying language or tone;

- Conduct or encouragement of illegal activity; and

- Disclosure of any information required to be maintained as confidential by law, regulation, or internal policy.

“Social networking” or “social media” means interaction with external websites or services based upon participant contributions to the content. Types of social media include social and professional networks, blogs, micro blogs, video or phone sharing and social bookmarking; and

“Comment” means a response to an article or social media content submitted by a commenter.

Text and Instant Messaging

District personnel shall not text or instant message any student individually unless the staff member is using a district-sponsored communication service for instructional purposes, which provides both administrators and parents/guardians with full access to the messages, or the staff member is an activity sponsor contacting students about the logistics of the activity. Staff shall not send messages that are personal in nature and not related to the business of the school or that contain confidential information to persons not authorized to receive that information. These restrictions do not apply to students who are the staff member’s relative in the first or second degree and are not meant to restrict appropriate and professional contacts made in the context of community organizations such as youth ministries, scout troops, community outreach groups, etc., and are not meant to restrict appropriate contacts with a student who is a babysitter or lawn care worker, etc.

- The Superintendent shall designate those staff persons who have management or administrator access to the district’s social media, including, but not limited to the ability to remove content from the school’s social media if determined to be inappropriate. Only content that is allowable on the school’s website is allowable on the school’s social media pages unless otherwise authorized by the superintendent.

- Staff should not be accessing or using social media during the contract day unless it is work-related.

Penalties

District personnel face the possibility of penalties, including employee termination, for failing to abide by district policies when accessing and using social media. Any inappropriate, harassing, intimidating, threatening or bullying to an employee of the district, regardless of whether the activity uses district equipment or occurs during school/work hours, is strictly forbidden and may lead to disciplinary action.

REFERENCE: DHAC Policy; EFBCA Policy; FL-R Policy

- Fraternization with students using social networking websites on the Internet:

Logos & Apparel

-

All sanctioned organizations must abide by Stillwater Board of Education policies CH, CH-E regarding the use of district logos and trademarks. Only current existing logos and marks may be used as outlined below. Sanctioned organizations may create unique marks/logos that represent the organization, but must comply with these policies.

-

Current Approved Logos

For access to any logos not included, the creation of new logos or any questions about SPS logos contact district PR & Communications Coordinator Barry Fuxa, 405.707.5025, [email protected]

-

-

-

-

Logos

-

Current Marks - ONLY current SPS Logos or marks can be used on uniforms that will be worn during competition.

-

The "S"

-

The "S" is the preferred mark for SPS uniforms.

-

Particular care should be made to utilize the correct current "S" or approved variations of it.

-

The "S" should if at all possible maintain it's three separate pieces - core, piping, and trim.

-

The color of the outer trim color of the "S" or Pioneer Logos should be such that it is distinct from the background color of the clothing.

-

Particularly small "S" logos may need to combine the piping and trim due to printing or stitching limitations, causing them to appear similar to the third crossed out example. This is acceptable.

-

Additional variations of the "S" can be requested by contacting the SPS PR & Communications Coordinator.

-

-

-

-

-

Preferred -All 3 pieces - Core, Piping and outer Trim - Colors can vary

Allowed Rarely - Piping and Trim merged - Used only when manufacturing limitations necessitate

Not Allowed - Attempt to mimic official S with different dimensions

Not Allowed - Missing Trim

Not Allowed - Missing Trim and Piping

The Pioneer

-

-

Only approved SPS owned variation of the Pioneer can be used for team apparel. Please contact the SPS PR & Communications Coordinator, [email protected], 405.707.5025, to confirm the logo you plan to use.

-

Vintage Marks

Vintage Marks-

-

-

The Vintage Pioneer S has been retired and should not be used.

-

Exceptions to this may be made on a case by case basis for the consideration of:

-

-

Excessive costs to replace existing equipment bearing the old "S," but future equipment orders must use the current logos.

-

Special uses that illustrate the history of SPS Athletics.

-

Used for special "vintage" uses only

-

-

-

-

Elementary Logos & Graphics

SPS is fortunate to have a strong district wide brand in the Stillwater Pioneers, but each of our elementary schools also features its own mascot. Some marks historically used by entities associated with SPS to represent these mascots are the intellectual property of other organizations and individuals and should not be used.

For the 2021-2022 school year, each elementary school is receiving a package of logos and word marks for a variety of uses. These logos while unique, feature a similar design language, creating a consistent feel across the district. It is recommended that these marks be used whenever possible.

Copyright

All logo use must be in good taste, consistent with SPS Logo guidelines, and comply with copyright law (Stillwater Board of Education Policies EFEA and EFEA-R ). Apparel, flyers, and other materials associated with SPS may not feature any mark not owned by SPS unless written permission is obtained from the original mark owner. Typically the only time logos not belonging to SPS should be used is to list sponsors.

Do not modify other graphics to represent the Stillwater Pioneers, any district school, or organization. Though your intent might be to tribute or honor the organization whose marks you are using, this is a violation of copyright law. Changing colors, reflecting, stretching, skewing, or any other modifications to designs is not enough to avoid potential legal action.

Across the nation you may see examples of schools and booster organizations violating copyright laws, leading you to think that it is an acceptable practice, but this is not the case. Schools are subject to the same copyright laws as any other organization.

Fines for copyright violations range from $200 to $150,000 for each work infringed. If you have any questions about artwork you are considering, please contact Barry Fuxa, PR & Communications Coordinator, [email protected], 405-707-5025.

Uniforms

All uniform designs must be approved by the Assistant Athletic Director and PR & Communications Coordinator.

Any purchase or donation of new uniforms or team provided apparel must be approved by the Director or Assistant Director of Athletics.

Apparel & Merchandise

-

Given to student organizations

-

Apparel given to student organizations, particularly athletic teams can affect adversely affect the district's Title IX compliance if not done in a fair, balanced, and coordinated way.

-

All donations to a student organization or team should be approved by the appropriate department or school administrator.

-

-

Sold

-

All fundraising apparel/merchandise must comply with the guidelines above.

-

If apparel/merchandise utilizes district marks, phrases, school names, etc. it must be purchased from approved vendors.

-

Vendors interested in creating products with SPS marks can request permission by submitting a non-exclusive licensing agreement.

-

-

The SPS PR & Communications Coordinator is a good resource for assisting you in navigating this process.

-

-